Tuesday, September 5, 2006

Next hot commodity? Arabica coffee beans

By CLAUDIA CARPENTER AND NGUYEN DIEU TU UYEN

BLOOMBERG NEWS

New York, home of the $4 cup of coffee, may be where the commodity gets its next price jolt.

Prices for arabica coffee beans on the New York Board of Trade could climb more than 20 percent in the next 12 months and outperform some of this year's best commodities investments, including copper and silver.

Demand for the beans is coming from Procter & Gamble Co., whose Folgers brand is the best-selling U.S. coffee, and Kraft Foods Inc., the maker of Maxwell House. Coffee sellers are turning to the arabica beans traded mostly in New York after a cheaper coffee variety called robusta rallied to a seven-year high in London last month.

"Now that robusta is moving up, it's bringing other grades into play," said Raymond Keane, a coffee trader in Charleston, S.C., for Balzac Bros. & Co., which supplies the commodity for Procter & Gamble and Kraft.

Coffee in New York may reach $1.30 a pound by the middle of next year, said Michael Coleman, managing director at Singapore-based Aisling Analytics, who helps run the Merchant Commodity Fund with $370 million. Arabica futures are little changed at about $1.08 this year, while robusta on the Euronext.liffe exchange in London jumped 30 percent.

The forecast for New York coffee compares with Macquarie Bank Ltd.'s prediction for a decline in copper, which jumped 75 percent this year. Silver, up 46 percent so far, will gain only 17 percent in 2007, Zurich, Switzerland-based analyst Edward Ennis at Julius Baer Holding AG forecast in July.

The International Coffee Organization forecasts a 2 percent rise in global coffee consumption to 7 million tons, helped by record growth at Seattle-based Starbucks Corp., the world's largest coffee-shop owner. Brazil, the world's biggest coffee producer, is unlikely in 2007 to repeat its bumper crop of 2.49 million tons this year, according to Conab, the forecasting agency for the nation's Agriculture Ministry.

About two-thirds of the world's coffee comes from arabica beans, which are used by coffee shops such as Starbucks. The rest is robusta, used in instant coffee, espresso and low-cost blends. Robusta beans give an espresso its froth, or "crema," and have about twice as much caffeine as arabica.

Coffee futures in London have risen in the past year as production from Vietnam, the largest robusta grower, declined because of a drought. Prices reached $1,586 a metric ton Aug. 22, the highest since 1999, after water damaged inventories in Italy.

Arabica prices haven't kept pace because Brazil this year is harvesting its second-biggest crop ever. Chances are Brazil's 2007 crop will decline because trees usually rest after a big harvest.

Dry weather is also hurting Brazil's plantations, and the flowering that starts in October will be damaged if there is no rain soon, hurting next year's crop.

Coffee roasters such as Cincinnati-based Procter & Gamble change the mix of bean varieties they use depending on price and consumer tastes.

"To the extent the ratio between the two contracts is way out of line, there must become a price point where arabica will become more viable than robusta," said Sean Corrigan, chief investment strategist at Diapason Commodities Ltd., which manages $5 billion of commodity investments.

The price spread between New York and London coffee is the narrowest in two years, boosting the appeal for buyers looking to use more of the mild-tasting beans. The premium for the most-active arabica contract is 38 cents a pound, down from 92 cents in March 2005, data compiled by Bloomberg show.

skip to main

|

skip to left sidebar

skip to right sidebar

Black as the devil, Hot as hell, Pure as an angel, Sweet as love.

Travel to Indonesia

Contact Our Team:

Raja Kelana Adventures Indonesia

Raja Kelana Adventures Indonesia

Email: putrantos2022@gmail.com

Facebook Messenger: https://www.facebook.com/putranto.sangkoyo

Our Partner

Blog Archive

-

▼

2008

(29)

-

▼

September

(24)

- COFFEE

- Kopi Gayo

- Marissa's Story

- Clearing The Java Confusion

- Pentingnya Perlindungan Indikasi Geografis atas Pr...

- COFFEE IN INDONESIA

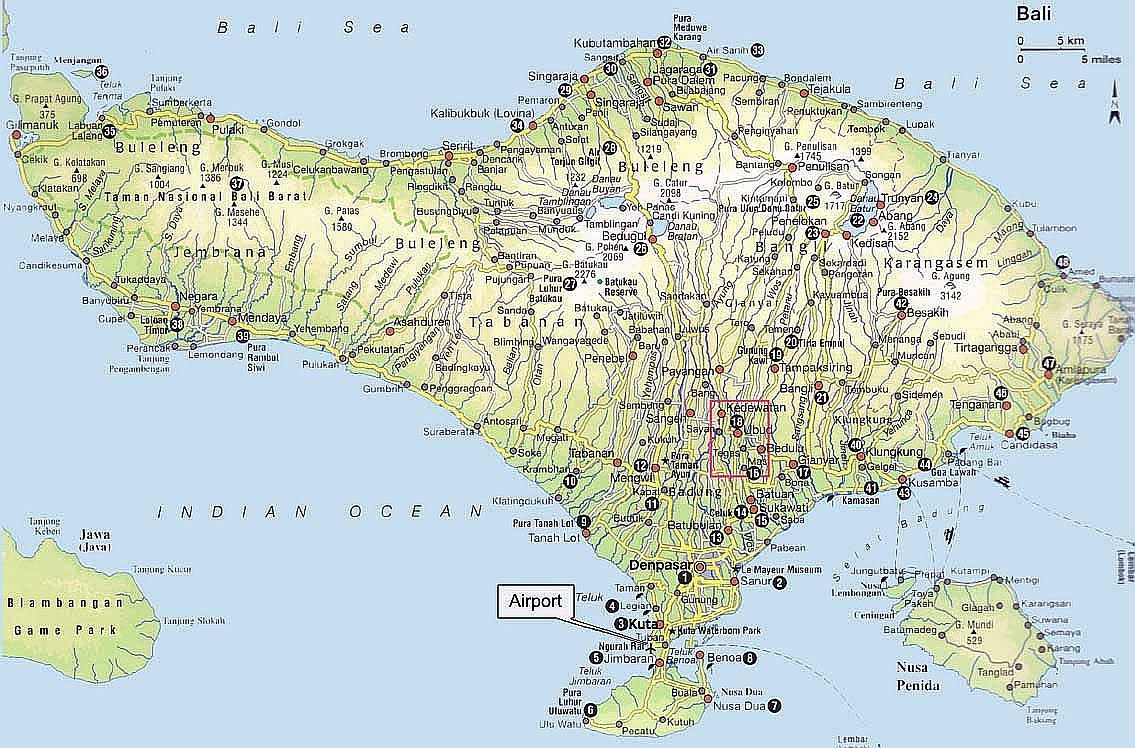

- Bali - Coffee Plantations

- Map of Indonesia

- Coffee in Indonesia

- Next hot commodity? Arabica coffee beans

- Famous Coffee Quotes

- Coffee - Illustrated

- Difference: Arabica vs. Robusta

- KOPI - Komoditi Unggulan

- Potensi Daerah Bangli - Kopi Arabika

- Banyuatis Coffee Manufacturing in Buleleng

- Kintamani Coffee - not Export Quality

- Bali Coffee - Export Opportunity

- Eco Friendly Balinese Coffe

- Arabica vs Robusta: No Contest

- How to Make A Good Coffee

- Bali Arabica

- Robusta vs. Arabica

- Bali - Robusta or Arabica ?

-

▼

September

(24)