Singapore launches coffee futures bourse

SINGAPORE — The Singapore Commodity Exchange is set to begin robusta futures trading on April 22 this year for the coffee variety in Asia.

"The launch of Singapore Coffee Futures Contract (SICOM Coffee) is timely as Southeast Asia has grown to become the largest producer and exporter of robusta coffee. SICOM Coffee is set to play a key role in establishing an Asian benchmark price for robusta coffee," Jeremy Ang, CEO of SICOM, said.

It is a physical delivery futures contract, traded in five metric tonnes per lot. Delivery will be made via warehouse receipts representing coffee stored in bonded warehouses in HCM City or Singapore.

This delivery mechanism provides for a short delivery period and simplified logistics.

Angeline Koh, deputy director, Sector Division, Financial Markets Strategy Department of the Monetary Authority of Singapore, said: "With Viet Nam and Indonesia being the world's two largest robusta coffee producers, there are many coffee exporters and traders based in Asia.

"A well-designed coffee futures contract will serve as an effective risk management instrument for the coffee industry based in Asia. As part of the development of Singapore's commodity derivatives market, we welcome the launch of unique Asian-centric contracts."

Luong Van Tu, chairman of the Vietnam Coffee and Cocoa Association, said: "The launch of SICOM Robusta Coffee deliverable to bonded warehouses in Viet Nam is representative of Asian trade which will benefit Vietnamese coffee growers and exporters."

Victor Mah, president of the Singapore Coffee Association, said: "Asia and in particular Southeast Asia is a key player in the global robusta coffee market but lacks an Asian price discovery platform. SICOM's Coffee will offer international market participants an effective hedging tool to manage their price risk." — VNS

skip to main

|

skip to left sidebar

skip to right sidebar

Black as the devil, Hot as hell, Pure as an angel, Sweet as love.

Travel to Indonesia

Contact Our Team:

Raja Kelana Adventures Indonesia

Raja Kelana Adventures Indonesia

Email: putrantos2022@gmail.com

Facebook Messenger: https://www.facebook.com/putranto.sangkoyo

Our Partner

Blog Archive

-

▼

2010

(19)

-

▼

March

(9)

- Harga Kopi di Lampung Barat Anjlok

- INDONESIAN COFFEE PRICE DATABASE

- Harga Kopi Arabika Menguat Didukung Kenaikan Komod...

- Coffee Species - Arabica and Robusta

- Coffee revives as Vietnam starts stockpiling

- Singapore launches coffee futures bourse

- Local coffee company a pick-me-up for literacy In...

- Developing Geographical Indication Protection in I...

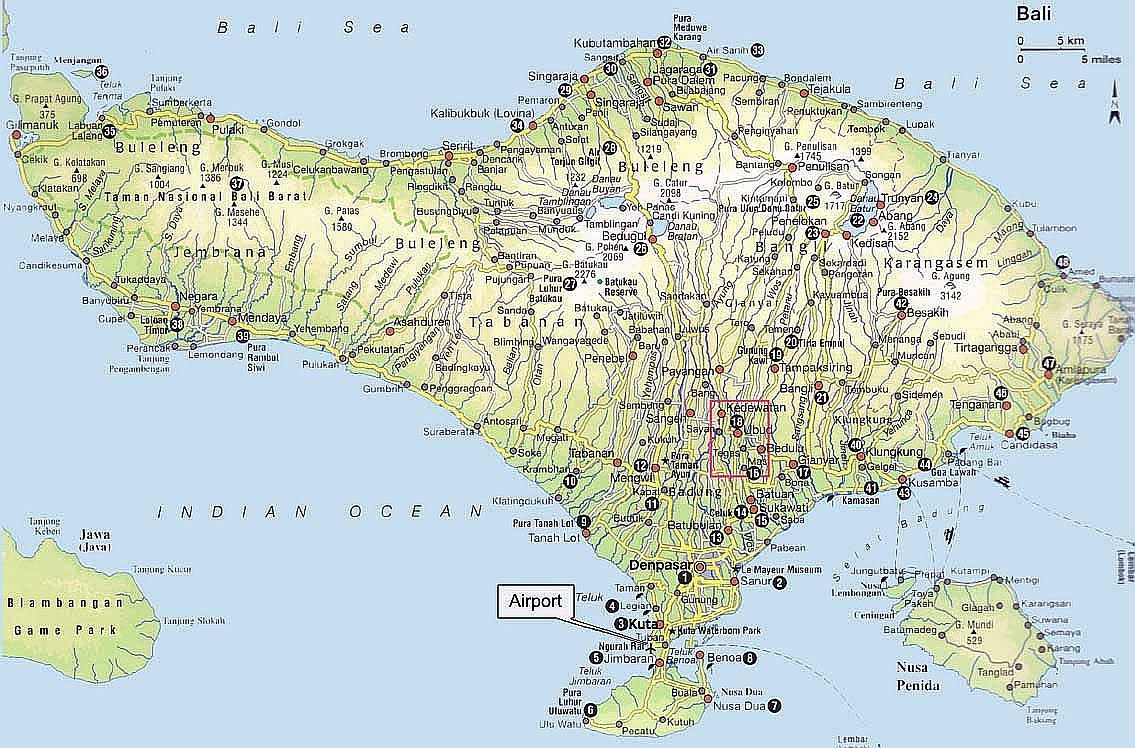

- One Hour Out: Bali Escape to the high country (f...

-

▼

March

(9)