Coffee revives as Vietnam starts stockpiling

Coffee recovered from its three-year low in London, and rebounded 2% in New York, after Colombia unveiled a 25% slide in production and Vietnam began building up stockpiles of robusta beans.

Robusta beans for March delivery closed up $9 at $1,199 a tonne in London, with the better-traded May contract jumping $23 to $1,245 a tonne.

The first price rise in four trading days followed confirmation of the start of a government-backed programme of coffee purchases by Vietnamese companies, with the aim of stockpiling 200,000 tonnes of the crop, nearly 20% of the country's annual production.

'Output should contract sharply'

Furthermore, many analysts believe the weak market which has prompted the stock-building will prompt Vietnam, the biggest robusta producer, to hold back on production.

World's biggest robusta producers, 2010-11 (year-on-year change)

1: Vietnam, 18.00m tonnes (-2.7%)

2: Brazil, 14.00m tonnes (+4.6%)

3: Indonesia, 8.25m tonnes (+3.1%)

4: India, 3.20m tonnes (-1.5%)

5: Uganda, 3.00m tonnes (+3.4%)

World: 53.99m tonnes (unchanged)

Source: Fortis Bank Nederland

"We expect prices to stabilise, since at the current low price levels output should contract sharply in Vietnam," Commerzbank analysts said.

They also took an optimist's view of a near-halving, to 22,000 tonnes, in exports of robusta beans last month from Brazil, the second-ranked producer.

"The sharp decline could be the result of higher domestic consumption, reducing the amount of robusta coffee that is available for shipments overseas," the bank said.

Colombian slide

Meanwhile, arabica coffee beans, which last week touched a five-month low, rose more than 2% in New York after Colombia reported February production at 650,000 bags (39,000 tonnes), down 218,000 bags year on year.

The figure was lower than the 700,000 bags that Colombia's coffee growers' federation had expected, although Luiz Munoz, the association's director, said that the country was still on track to hit a half-year production target of 5m bags (300,000 tonnes).

Output in Colombia, the second-biggest producer of arabica beans after Brazil, has been dented by poor weather and a replanting programme which has reduced short-term output potential.

Buy stops triggered

Technical factors also helped the arabica market, after the May contract broke through a resistance level at 132 cents a pound.

World's biggest arabica producers, 2010-11 (year-on-year change)

1: Brazil, 38.95m tonnes (+13.9%)

2: Colombia, 10.0m tonnes (+8.1%)

3: Ethiopia, 8.25m tonnes (-4.5%)

4: Peru, 4.25m tonnes (+6.3%)

5: Mexico, 4.2m tonnes (-4.5%)

World: 86.11m tonnes (+7.0%)

Source: Fortis Bank Nederland

"Getting above there set a few buy stops off," Ralph Hawes, at Sucden Financial in London, told Agrimoney.com, adding that technical analysis suggested that a close at about 132.50 cents a pound could spark a move to 136-137 cents a pound.

Coffee traders have also flagged managed funds' increasing bearishness over coffee, with short positions exceeding longs by 3,195 contracts last week, according to regulatory data.

Ironically, such movements have often, as in autumn 2008 and spring 2007, heralded an upturn in prices.

New York's May coffee contract closed up 1.3% at 132.75 cents a pound.

skip to main

|

skip to left sidebar

skip to right sidebar

Black as the devil, Hot as hell, Pure as an angel, Sweet as love.

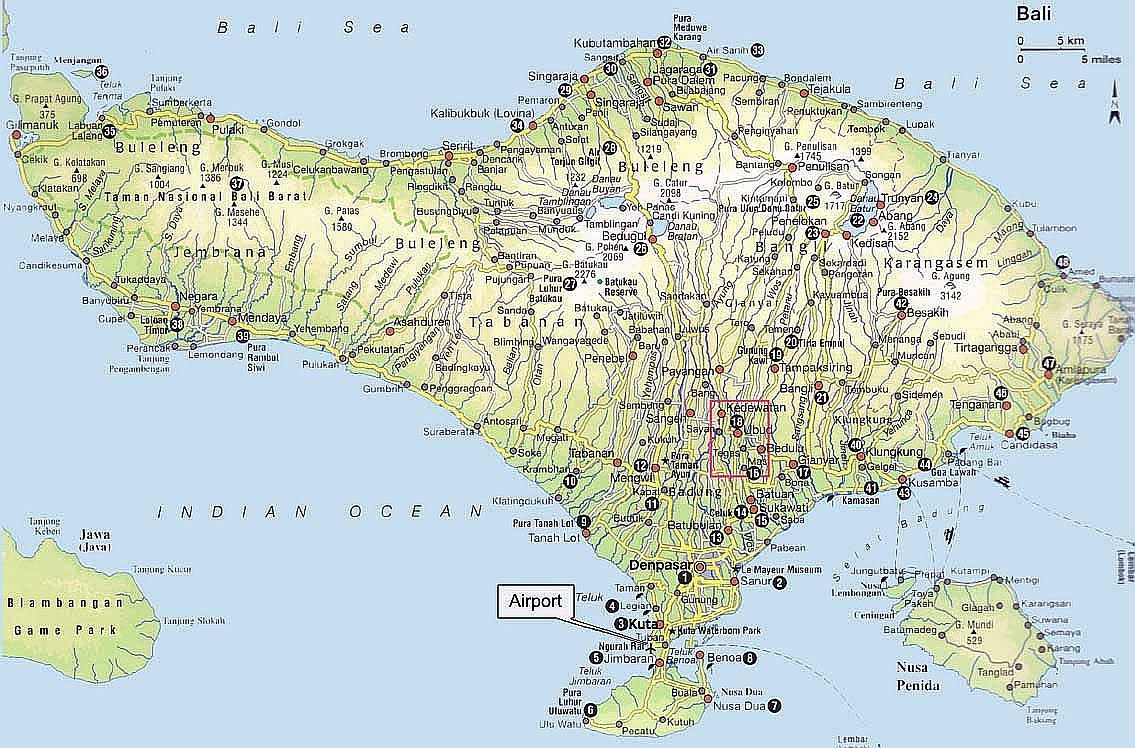

Travel to Indonesia

Contact Our Team:

Raja Kelana Adventures Indonesia

Raja Kelana Adventures Indonesia

Email: putrantos2022@gmail.com

Facebook Messenger: https://www.facebook.com/putranto.sangkoyo

Our Partner

Blog Archive

-

▼

2010

(19)

-

▼

March

(9)

- Harga Kopi di Lampung Barat Anjlok

- INDONESIAN COFFEE PRICE DATABASE

- Harga Kopi Arabika Menguat Didukung Kenaikan Komod...

- Coffee Species - Arabica and Robusta

- Coffee revives as Vietnam starts stockpiling

- Singapore launches coffee futures bourse

- Local coffee company a pick-me-up for literacy In...

- Developing Geographical Indication Protection in I...

- One Hour Out: Bali Escape to the high country (f...

-

▼

March

(9)