Indonesia: Threat to coffee exports

Asia | 19 Jul 2013

A combination of short- and long-term factors are putting at risk Indonesia’s position as one of the world’s leading coffee producers, while rising domestic demand could eat into stocks available for the profitable export market.

The coffee sector is a major contributor to Indonesia’s agriculture exports, generating revenue of $1.25bn last year, while its annual production of around 700,000 tonnes of coffee ranks it third behind world leaders Brazil and Vietnam. The industry supports at least 1.4m growers and many more employees, most of whom are located in provinces of Lampung, South Sumatra and Bengkulu. While the bulk of local production is Robusta, a bitter coffee variant used in instant drinks and espresso, some 22% of total output is the less caffeinated Arabica species.

Indonesia’s place as the third-ranked global producer is under threat by the country it supplanted in the 2008/09 season, Colombia. The Latin American grower has been steadily increasing output over the past few years as new plantings have started to yield crops, replacing production capacity lost some five years ago to a severe bout of coffee rust, a fungus that blighted many established trees.

A combination of storms that damaged buds in December and January and more recent heavy rains that delayed the season’s harvest into June, one month late, is expected to affect Indonesia’s output in some areas, and possibly push down stocks available for export. According to a report compiled by the Bloomberg news agency in mid-June based on estimates from local experts, the crop available for export this year could amount to 6.42m 60-kg bags, the equivalent of 385,000 tonnes, from a harvest just under 600,000 tonnes or 9.92m bags, well down on the averages of recent years.

Growing competition and bouts of unfavourable weather are not the only issues that the industry faces. Another is the increasing age of many of the trees in production. According to the Indonesian Coffee and Cocoa Research Institute (ICCRC), many of the trees were planted more than 20 years ago, meaning they are above the five- to 20-year age range for optimum production, with older trees being up to 30% less productive.

“The reality is that many of the crops are already old,” the ICCRC said in a statement issued in early June. “This problem is like a time bomb that can threaten the coffee industry any time and change Indonesia’s status from a coffee exporter into an importer.”

With new plantings adding only 0.02% a year to the area under cultivation, the institute said this meant plantations were aging quickly, putting at risk output and revenue, the ICCRC said.

“Production, farmers’ revenue and state foreign-exchange receipts would also weaken,” the statement said. “It is therefore necessary for co-operation to take place between various sides, including the government, the private sector, entrepreneurs and farmers who all play a direct role in the coffee production chain and business.”

In a recent report, the US Department of Agriculture also noted that Indonesia’s coffee sector had an “abundance of older, less productive trees” that were more prone to being affected by severe weather patterns. Added to this, the department said, efforts to replace older trees with new plantings had been slowed by what it said were bureaucratic problems between local and central government.

Though the ICCRC’s warning about Indonesia becoming a net importer of coffee is unlikely, given the sheer volume of production, rising domestic demand has reduced the amount available for export. While forecasts are that production this year will remain flat or post a modest increase, predictions are that domestic demand will grow to as much as 4m 60-kg bags over the coming year. This represents a one-third increase on previous domestic consumption levels, and equates to well over 35% of total output.

Moelyono Soesilo, the purchasing and marketing manager at Java-based exporter Taman Delta Indonesia, told the Reuters news agency in mid-May that the rising domestic demand was the result of more Indonesians acquiring the coffee habit.

“Local consumption is getting higher because more young people love to drink coffee,” he said. “Local coffee shops and independent, small roasters are flourishing. We will see that in the next three to five years, it is easy to increase local consumption to 7m-8m bags.”

To meet this rising domestic demand while still maintaining its position in the top three international producers, either the total area under cultivation will need to be expanded or a cull of aged trees conducted to gradually boost yields. Either way, it would be a matter of five years or so before new trees became fully productive, meaning Indonesia could see its global market share eroded as rivals such as Colombia move to boost output.

skip to main

|

skip to left sidebar

skip to right sidebar

Black as the devil, Hot as hell, Pure as an angel, Sweet as love.

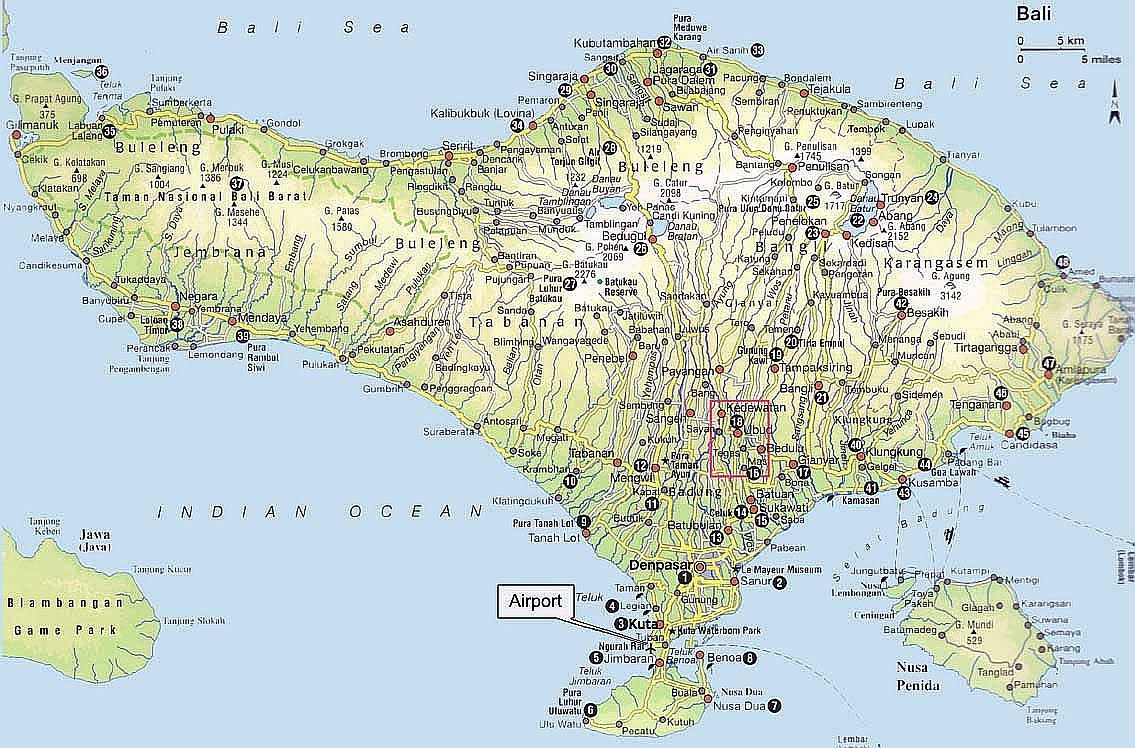

Travel to Indonesia

Contact Our Team:

Raja Kelana Adventures Indonesia

Raja Kelana Adventures Indonesia

Email: putrantos2022@gmail.com

Facebook Messenger: https://www.facebook.com/putranto.sangkoyo