ANALYSIS-Indonesia supply woes to add froth to coffee market

Wednesday March 02, 2011 01:06:02 AM GMT

COFFEE /INDONESIA (ANALYSIS, PICTURE)

* Indonesians reluctant to sell, beans quality bad

* Vietnam emerges as key seller

* Sumatra beans at $80 discount; Vietnam $140

By Lewa Pardomuan

SINGAPORE, March 1 (Reuters) - A bad coffee harvest in Indonesia could compound worries about a scarcity of good quality beans, allowing the world's second-largest robusta producer to give a filip to global prices even as rival Vietnam steps up exports.

More robustas from top producer Vietnam could potentially weigh on prices, but lagging sales from Indonesia will send buyers scrambling for beans -- replicating a supply concern in the arabica market after heavy rains slashed output in South America.

With physical tightness expected to influence sentiment in 2011 and speculators unwilling to turn short, robusta is likely to ride on fundamentals to reach new highs beyond a near three-year peak around $2,400 a tonne.

Robusta, a bitter-tasting variety used in instant coffee, has tracked rallies in premium arabica beans to levels not seen in more than 30 years to stand at around 278 U.S. cents a pound.

Helping underpin prices will be an increase in global consumption.

This will put a floor under prices, even though Vietnam's harvest will again be good.

"We have seen investors shifting their focus from grains to soft commodities. It's due to quality concerns. Investors may think the grains and oilseeds markets are overdone now," said Ker Chung Yang, investment analyst at Phillip Futures in Singapore. "By the end of the year, robusta may top $2,800 (a tonne)."

Excessive rains have troubled Indonesia's output in 2010 and early in 2011. This has triggered a shift in the harvesting season and raised fears there will not be many beans left in the middle of this year when the harvest normally starts.

While Vietnam has emerged as a key seller following a bumper crop and high prices in London, exporters in Indonesia are struggling to find quality beans after an early harvest yielded a largely black, rotten and mouldy crop.

Indonesian robusta is more expensive than Vietnamese beans because of its bold flavour. Despite favourable international prices, many exporters are reluctant to sell forward, preferring to honour old contracts and prevent defaults.

Indonesian robusta fetches a discount of $80 a tonne to London's May contract -- much smaller than the $140 discount for beans from Vietnam.

SHORT SUPPLY

"Unfavourable weather conditions in major coffee-producing regions continue to increase uncertainties regarding supplies of some origins," the International Coffee Organization said in its latest report.

"Currently there are possibilities for replacing those origins in short supply. However, this is likely to become more difficult."

Robusta accounts for about 85 percent of Indonesia's output, while the rest is higher value, aromatic arabica.

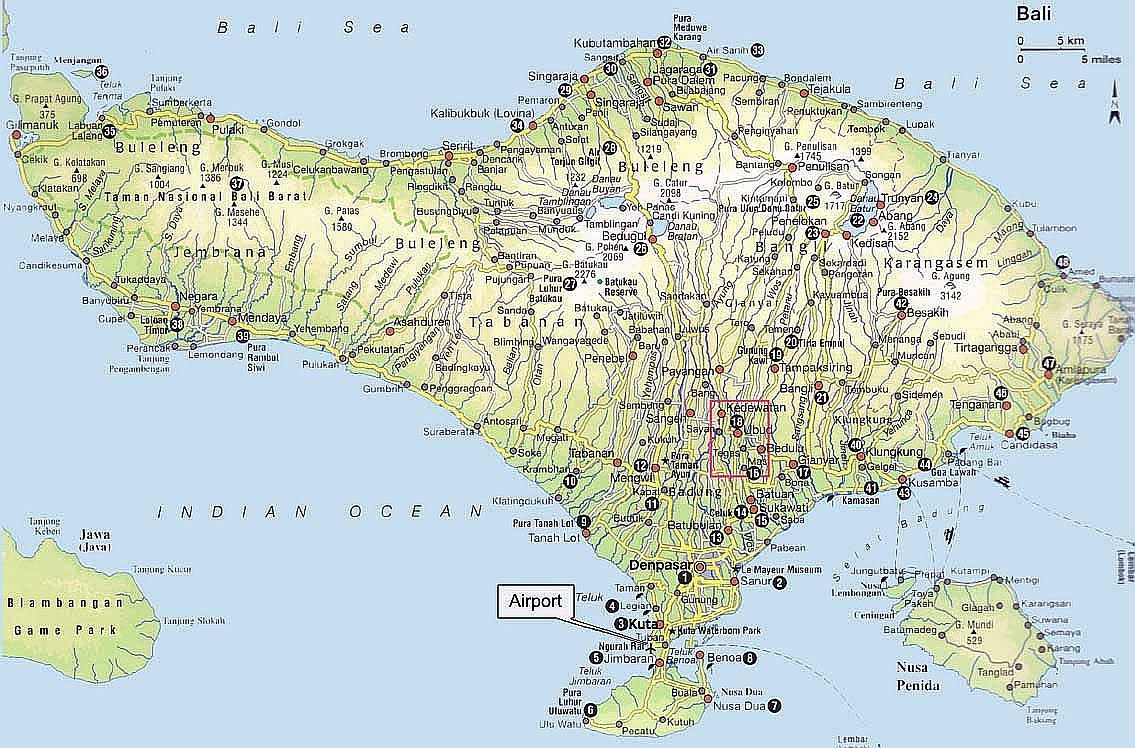

Combining robusta and arabica, Indonesia is the world's third-largest producer after Brazil and Vietnam, accounting for around 7 percent of global output. It mainly exports beans to roasters in Europe.

"At the same period last year, you could buy beans at $100 to $120 discount, but differentials have not widened now, even though more beans are coming in," said a dealer in Bandar Lampung, the provincial capital of Lampung on the main growing island of Sumatra.

"Exporters only want to sell nearby. Also, many local roasters are devouring domestic beans because they are expanding capacity. People have been expecting the differential to widen because of pressure from futures, but it doesn't happen."

Harvests in Sumatra usually start in March or April, but farmers have been picking cherries since January as the flowering season began earlier in some areas after the previous crop ended in August last year.

The ICO puts Indonesia's output at 9.5 million 60-kg bags in the crop year to September 2011, down 16.5 percent from a year ago, while Vietnam's output has risen 1.3 percent from the previous crop to 18.43 million bags.

Wild weather could cut Indonesia's coffee exports by 15 percent to 7.4 million bags in the 2010/11 marketing year, according to the USDA, or around 7 percent of global exports.

Vietnam's coffee exports between October 2010 and February, the first five months of the 2010/2011 season, were estimated to reach 8.75 million bags, up 5 percent from 8.33 million 60-kg bags shipped a year ago, the government said.

KEEN SELLERS

"Even if more than half of the Vietnamese 2010/2011 crop has already been sold up to now, farmers remain keen sellers," said a dealer in Hong Kong, who trades Vietnamese robusta.

"At a price of $2,380 in London, for sure you are a seller. It's historically one of the best prices farmers can get. It would be a mistake to stop selling."

Some farmers in Vietnam are still holding on to stocks, hoping for domestic prices to surpass an all-time high above $2,190 a tonne, but they could be tempted to sell the rest at high prices to roasters unable to secure supply from Indonesia.

"I guess roasters have to source from Vietnam, and even local Indonesia roasters often import from Vietnam whenever the domestic price is high," said a dealer in Singapore who trades robustas.

"Roasters have preferences when it comes to taste, but for the market here, we prefer Indonesian robusta because it has a stronger taste, while Vietnamese beans are more neutral."

For the Indonesians, steady demand from local roasters will ensure domestic prices stay at their highest since mid-2008 at around $2,200 a tonne. The USDA expects domestic consumption to rise nearly 3 percent to 1.9 million bags in the 2010/11 year.

"These days, there's no need for coffee traders to worry," said Rachim Kartabrata, executive director of the Indonesian Coffee Exporters Association. "If there are no foreign buyers, domestic roasters will definitely buy."

The association, which uses calendar year, expects Indonesian coffee bean production in 2011 to fall by 30 percent from an estimated 600,000 tonnes in 2010, as rains in key producing areas damage cherries.

(Additional reporting by Fitri Wulandari in JAKARTA; Editing by David Fogarty)

(c) Copyright Thomson Reuters 2011. Click For Restrictions. http://about.reuters.com/fulllegal.asp

skip to main

|

skip to left sidebar

skip to right sidebar

Black as the devil, Hot as hell, Pure as an angel, Sweet as love.

Travel to Indonesia

Contact Our Team:

Raja Kelana Adventures Indonesia

Raja Kelana Adventures Indonesia

Email: putrantos2022@gmail.com

Facebook Messenger: https://www.facebook.com/putranto.sangkoyo

Our Partner

Blog Archive

-

▼

2011

(22)

-

▼

March

(12)

- Coffee 'risk' for Sumatra reserve Indonesian cof...

- UPDATE 2-Indonesia Feb coffee exports jump, stockp...

- ANALYSIS-Indonesia supply woes to add froth to cof...

- Coffee retailers set to raise prices by 10-12%

- Coffee beans price hits 34-year high commodity sh...

- Rising Coffee Prices - Heavy Rains Linked to Globa...

- Coffee sector needs sustainable development strategy

- Starbucks CEO Howard Schultz discusses turnaround

- A Changed Starbucks. A Changed C.E.O.

- FUTURES FILE: Frothy coffee prices near $3

- Rising Coffee Prices

- Harga Kopi Terus Menggila, Cuaca Jadi Kambing Hita...

-

▼

March

(12)