International Coffee Organization: Coffee Market Report November 2009

(Drinks Media Wire). Prices of Colombian Milds and Brazilian Naturals remained firm in November, while those of Other Milds fell slightly. Robusta prices continued to be subject to downward pressures with the arrival on the market of the new Vietnamese harvest. The monthly average of the 2nd and 3rd positions on the London futures market was down from 66.74 US cents per lb in October to 62.84 US cents per lb in November.

On the basis of statistical data for exporting countries, total production in crop year 2008/09 was 128 million bags. For crop year 2009/10 my preliminary estimate of total production is between 123 and 125 million bags. Apart from Brazil, where production in 2009/10 will be reduced, a number of other exporting countries will also record lower production levels, notably Colombia and India. In the case of Colombia, production in crop year 2009/10 will not be as high as forecast due to a number of factors, including the recurrence of coffee berry borer (CBB) infestation and the continuation of the coffee tree rejuvenation rogramme.

It should be noted that inflation has contributed towards increases in the cost of production in many countries, particularly on account of higher fertilizer prices and labour costs. The Vietnamese authorities have recently announced a 5% devaluation of the Vietnamese dong against the US dollar.

Exports by all exporting countries during October totalled 6.9 million bags, bringing the cumulative total for calendar year 2009 (January – October 2009) to 79.8 million bags, representing a fall of 1.9% in relation to the figure of 81.4 million bags for the same period in 2008.

In November, I participated in the 23rd Sintercafé Conference in the Guanacaste coffee region of Costa Rica where I outlined the key features of the International Coffee Agreement 2007. I also participated in the 17th ENCAFE Conference in Salvador, Brazil on the theme of the growth in the market for quality Coffee.

In my presentation I gave a detailed analysis of consumption trends and outlined the behaviour of the market during the world economic crisis. Finally, I attended the 49th General Assembly of the InterAfrican Coffee Organisation (IACO) in Accra, Ghana. In my address to the delegates of the 25 Member countries of this Organization, I reviewed the situation of African coffee production and highlighted the need to evelop rehabilitation and replanting programmes to improve coffee productivity and quality.

Price movements

The monthly average of the ICO composite indicator price fell by 1.17% from 121.09 US cents per lb in October to 119.67 US cents per lb in November (Table 1). However, the behaviour of prices during the first week of December indicates a slight recovery in prices1. Graph 1 shows changes in the ICO daily composite indicator price since 3 November 2008. Graph 2 shows daily indicator prices for the four roups of coffee since 3 November 2008. Prices for Colombian Milds and Brazilian Naturals remained firm while those for Other Milds and Robustas fell. This fall was less marked for Other Milds than for Robustas.

skip to main

|

skip to left sidebar

skip to right sidebar

Black as the devil, Hot as hell, Pure as an angel, Sweet as love.

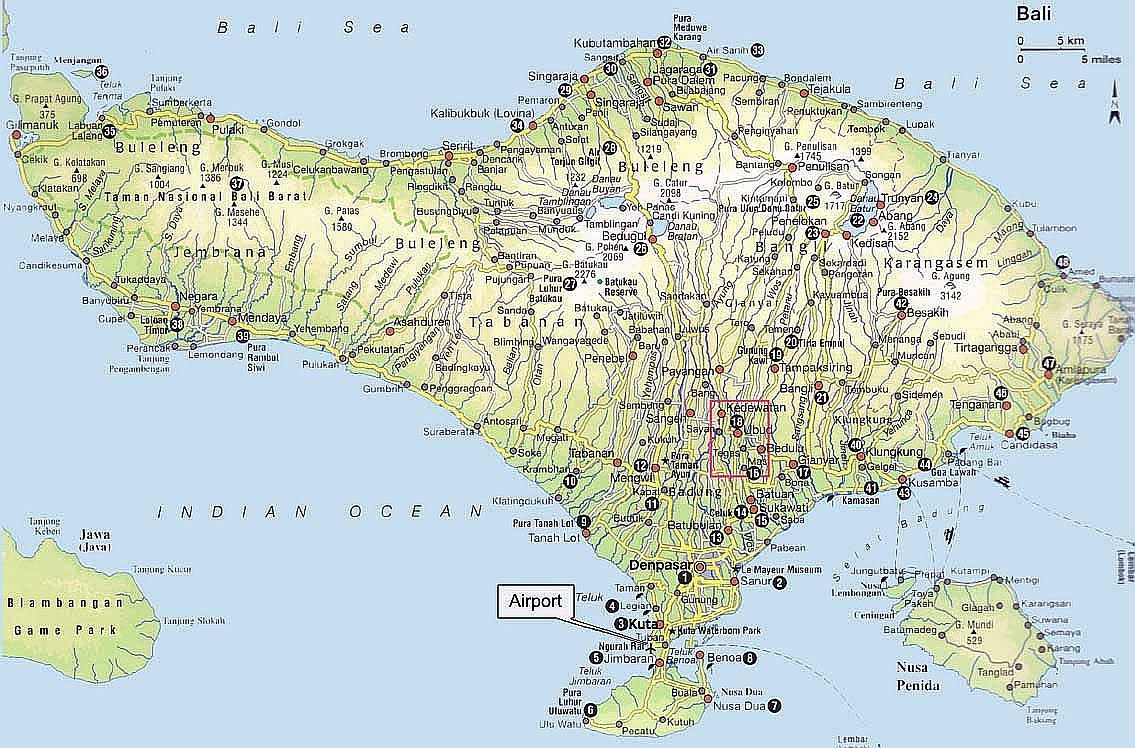

Travel to Indonesia

Contact Our Team:

Raja Kelana Adventures Indonesia

Raja Kelana Adventures Indonesia

Email: putrantos2022@gmail.com

Facebook Messenger: https://www.facebook.com/putranto.sangkoyo